Content

By doing so, debt guidance will never be stored on the mobile device. In some cases, a cellular deposit takes expanded to process and need a good keep. SmartBank usually email address you to reveal whenever we you need to hold a mobile deposit and can include details of when you should predict the money becoming readily available. As well as, non-examined company membership meet the requirements to utilize mobile deposit. After the teller have processed the look at, they will give a receipt summarizing your order and cash for those who expected they. Opinion the brand new acknowledgment very carefully to ensure all of the details try right and you will number hardly any money provided.

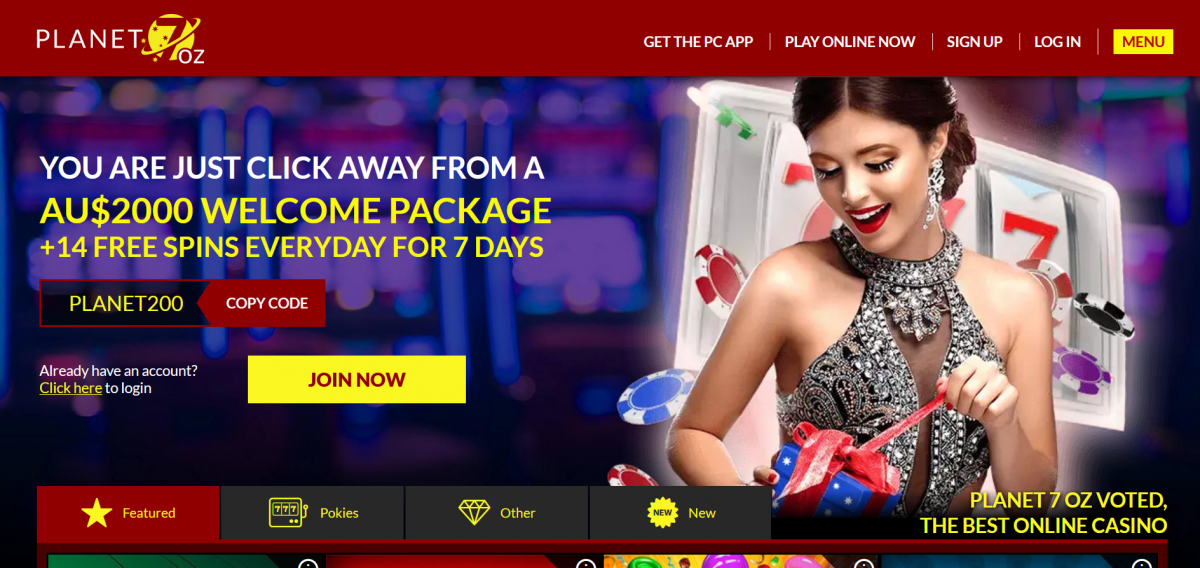

Do you know the restrictions from mobile take a look at places?: best online casino promotions

Once you’ve confirmed what you appears correct, faucet “Submit” or a similar key in the application so you can finalize your own put. The financial institution’s program validates the newest take a look at because of the confirming routing and you can membership quantity, checking to have duplicates, and assessing picture quality. Inaccuracies get punctual guide comment, where bank assesses the brand new deposit contrary to the affiliate’s account background to own problems.

- A bit the same fee algorithm is employed various other financial procedures via cell phones, such Siru mobile payment, Boku otherwise PayforIt.

- You could have the possibility to spend a charge for your finance getting readily available the same or the next day.

- This particular feature limitations the total amount you’re in a position to deposit on your smart phone for each and every business day.

- Cellular put is very smoother if you would like put a view once regular business hours, for the a financial escape, if you don’t more a week-end.

- Yes, your mobile deposit limitations get for each eligible membership when you choose in initial deposit to help you membership as well as on the brand new Enter into Count screen.

Even though their mobile deposit appears to come-off rather than a hitch, it will remain smart to retain the brand new papers consider after it clears, and when truth be told there’s a problem later on. Mobile look at deposit is a mobile banking tool that enables your so you can put checks to your checking account utilizing your mobile device. In a nutshell, pay because of the cellular gambling enterprises offer an instant, safer, and you will affiliate-friendly means to fix put money using your mobile statement otherwise prepaid balance. With several video game, bonuses, and the power to take control of your bankroll easily, mobile phone statement gambling enterprises are very a leading selection for of several on line gambling enterprise enthusiasts. Because of the leverage cellular charging you characteristics, professionals will enjoy instantaneous places without needing to express sensitive banking advice, guaranteeing one another benefits and you can reassurance.

You’re notified of your limitations once you make an effort to generate in initial deposit. Once you’ve achieved your restrict, you would not have the ability to make other deposit before next day otherwise day. Cellular consider put is here now to remain, and its own coming appears guaranteeing.

Cellular payments are in people website name because the 1990’s, if the enjoys of Sony Ericsson and you can Coca-cola experimented with to find goods thru Texting. Purposefully placing an identical cheque more often than once is known as con. Ripoff is a significant criminal offense that is punishable by the a great jail phrase.

Require the HSBC Mobile Financial app?

Once you’ve done and make their deposit, keep your own look at until the full amount provides cleared your bank account. The bank get advise that you keep your seek out a great certain period, such four to help you one week. Once the look at features removed and you also feel comfortable taking care of your own take a look at, shred it or damage it safely. Check your software’s cellular take a look at put recommendations to be sure you’re also composing a correct statement ahead of continuing.

When there is a hold on your bank account unconditionally, you do not manage to put a using the mobile application. Make an effort to speak to your financial to answer the new keep best online casino promotions prior to in initial deposit. Immediately after placing a with the mobile app, it’s crucial that you properly store the fresh bodily search for several days in case there is people issues with the newest put. Try to wait until the new date on the consider before placing it. – Lender A have actually a mobile put restriction out of $2,five hundred a day and $5,100000 for each 29-time months.

Here’s a list of the new mobile take a look at put limitations at the biggest banks that you could site. Should you ever want to site the images you took of your mobile consider deposit, your lender can offer the choice to take on them when you accessibility their report. Very cellular financial programs do not allow one store pictures of the monitors you put on your own mobile phone. Having a mobile banking software, you could manage your profit from your cell phone without the need to sit at the a computer or check out a branch of one’s lender. It’s much more an easy task to entirely digitize your financial lifestyle, counting on credit and you will debit cards for orders, playing with programs to transmit money to your members of the family, and you can spending expenses on line. Cellular look at put, also referred to as cellular put, enables you to put paper checks into your savings account having fun with a cellular application in your mobile.

Which have cellular view put, you could potentially put a check through your portable otherwise tablet, as well as the process merely takes just a few minutes. In other words, you don’t need to use your time and effort and you can gasoline currency to go to a bank branch otherwise Atm, and you wear’t need to worry about . If the latest membership doesn’t render this particular aspect, it can be value contrasting checking account to find one that boasts mobile take a look at put and other useful digital banking has.

Compensation can impact the spot and you will acquisition where including businesses appear on this page. The such as place, purchase and you may organization reviews is actually subject to changes based on article decisions. Cellular Consider Deposit allows you to deposit your inspections instead of a good stop by at the lending company. Make use of the Citi Cellular banking App in order to deposit your next view together with your smartphone.

Quite often, the fresh placed financing are around for you the go out after the deposit try paid. Yet not, not all profile qualify to own mobile places, so there is constraints about how exactly much money will be transferred in that way. The new mobile put function is designed to become member-friendly and you may secure.

Electronic financial means all the interactions out of banking which have technology. That means that digital financial boasts things like on line banking out of your own desktop plus the online characteristics one banks give, such as payroll equipment an internet-based transfers. Chase’s webpages and you will/otherwise cellular words, privacy and you will protection formula usually do not apply at your website or software you happen to be going to check out. Delight opinion its terminology, confidentiality and you can shelter formula observe how they affect your. Chase isn’t accountable for (and you will doesn’t give) people issues, characteristics or blogs at that 3rd-party site otherwise software, with the exception of products and services you to explicitly bring the newest Chase name. Which have Pursue to have Business you’ll discover advice away from a group of business experts who specialise in aiding improve cash flow, bringing borrowing from the bank possibilities, and managing payroll.

Luckily, for many who lender having a lending institution that has a cellular software, you do not need check out a branch to put a good view. As an alternative, the likelihood is you are able to deposit a from anywhere having fun with merely your smartphone. Cellular look at put try a quick, smoother treatment for deposit financing making use of your smart phone.

If one makes mistakes when promoting a check otherwise taking photos of your take a look at, it can cause your financial business so you can refuse your take a look at. You may have to waiting to work through any issues or sense a delayed in getting the money. Bringing these types of actions is also best protect your finances and personal advice while using the the unit to help you put checks otherwise over almost every other financial tasks.