Content

A part 162 exchange otherwise business fundamentally includes any hobby if the connection’s number one goal to possess engaging in the game is for earnings or money and also the connection are mixed up in interest that have continuity and you can volume. More resources for what qualifies as the a swap or organization to own purposes of area 199A, understand the Guidelines to own Setting 8995, Accredited Business Money Deduction Simplistic Calculation; or even the Recommendations to possess Form 8995-A great, Certified Business Money Deduction. Inside 12 months 1, a partnership borrows $step one,100 (PS Responsibility 1) away from Financial step one and you may $step 1,100 (PS Accountability dos) from Financial 2.

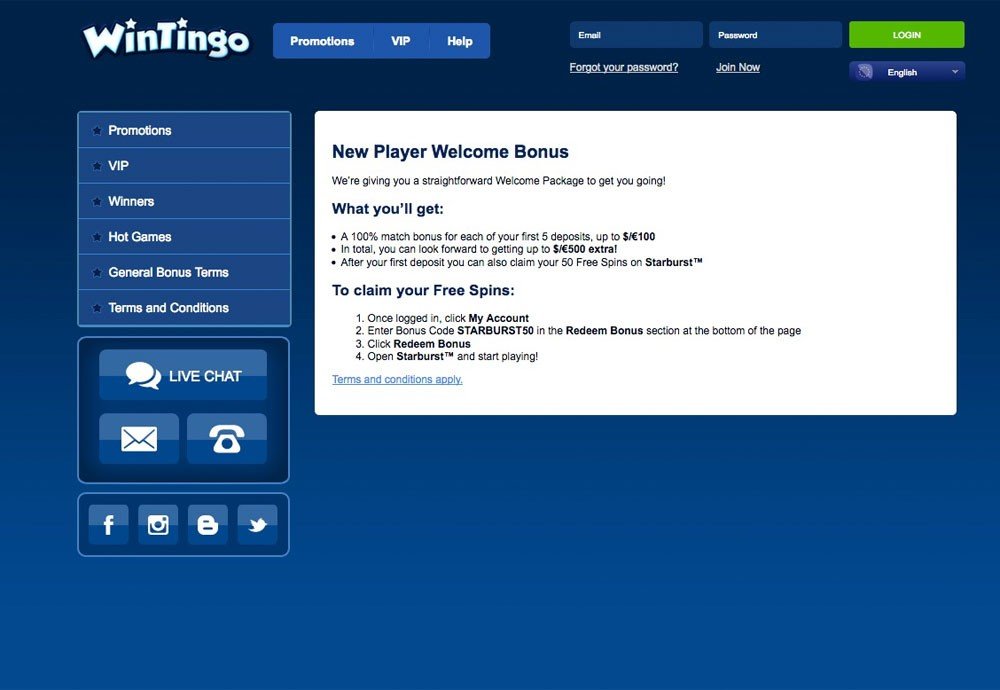

Tricks to winning on pokie machines | File

For example, it chooses the brand new bookkeeping strategy and you will decline actions it will explore. The partnership as well as can make elections under the following parts. Whenever a good partnership’s government go back is revised or altered the need, it might change the partnership’s state income tax return.

Yahoo Shell out

Form 8938 have to be submitted each year the value of the newest partnership’s specified overseas economic assets match otherwise is higher than the new reporting endurance. For more information on home-based partnerships which might be given domestic entities as well as the sort of overseas economic possessions that must definitely be stated, understand the Tips to own Form 8938. Enter into all other change or business earnings (loss) not incorporated to the contours 1a thanks to six. Such, don’t are disgusting receipts out of farming online 1a. Along with, don’t are on line 1a local rental interest income otherwise portfolio income. To possess laws and regulations of if a different union have to document Form 1065, discover Which Must File , before.

On each Schedule K-step one, enter the term, address, and you can identifying level of the connection. Whenever attaching comments to help you Agenda K-step 1 to help you statement considerably more details to your mate, suggest there is an announcement for the next. So that possibly a public relations or an excellent DI to own big visibility, they must make by themselves offered to fulfill individually to your Irs in the united states in the quite a long time and set because the influenced by the fresh Internal revenue service, and may features a road target in the us, a good You.S.

For the Connection X’s Mode 1065, it will answer “Yes” to question 2b of Schedule B. Discover Example dos on the recommendations for Schedule B-step one (Function 1065) for advice on providing the remaining portion of the information needed of organizations responding “Yes” to that particular matter. Do not subtract money to have people to help you old age otherwise deferred payment agreements in addition to IRAs, accredited arrangements, and you may basic worker pension (SEP) and easy IRA preparations on this line. These amounts is actually said inside field 13 from Schedule K-step 1 using password Roentgen and they are deducted by the lovers to your her production.

Internet Money Taxation Revealing Requirements

Because the couples are allowed to get this election, the relationship cannot deduct this type of number otherwise were her or him as the AMT issues tricks to winning on pokie machines to the Agenda K-1. As an alternative, the partnership goes through every piece of information the fresh people must figure their independent write-offs. On the internet 13d(1), go into the type of expenses claimed online 13d(2). Enter on line 13d(2) the new accredited expenditures paid or incurred in the taxation year to have and this an election less than section 59(e) can get pertain. Go into so it matter for everybody people whether or not people spouse produces a keen election below part 59(e).

Time Witch

Right here, the new accused is actually overwhelmingly girls and often subjected to torture ahead of are murdered otherwise compelled to flee. India’s National Crime Info Bureau registered 2,468 murders stemming out of witchcraft accusations ranging from 2001 and you may 2016, several one to probably doesn’t make up all the incident and and that doesn’t come with examples in which implicated witches live the ordeal. Even though these persecutions are illegal and other Indian claims features passed laws and regulations concentrating on the fresh habit, they will continue to endure.

If your relationship produced an election to help you subtract a portion of their reforestation costs on the Agenda K, line 13e, it must amortize more an enthusiastic 84-week months the brand new part of such expenses more than the new count deducted for the Plan K (see point 194). Subtract online 21 only the amortization of them excessive reforestation costs. Go into the partnership’s contributions so you can personnel benefit software perhaps not said in other places on the get back (such as, insurance rates, health, and you can hobbies software) that aren’t part of a retirement, profit-sharing, an such like., package included on the internet 18. If the partnership states an excellent deduction to possess wood depletion, over and you may attach Mode T (Timber), Tree Issues Plan.

Attach a statement so you can Schedule K-1 appearing the new lover’s distributive display of your own amounts that companion use to find the newest amounts in order to report on their Function 3468, Region II. If your partnership holds a primary or secondary need for an RPE one to aggregates several investments or businesses, the relationship might also want to tend to be a copy of the RPE’s aggregations with every companion’s Plan K-1. The relationship are unable to break apart the newest aggregation of another RPE, nevertheless could possibly get include positions or organizations to your aggregation, and in case the brand new aggregation criteria is fulfilled.

How Money Is Common Among Lovers

The connection switches into the new remedial approach regarding assets Y. In the 1st season, P has $ten from part 704(b) publication depreciation, that’s assigned equally to help you A and you will B to have guide intentions ($5 for each). However, P has $0 of income tax depreciation in terms of assets Y. Within the corrective approach, to have tax objectives, P allocates $5 from remedial earnings so you can A good and you may $5 from a remedial depreciation deduction so you can B in terms of assets Y. The brand new definitions for the report fundamentally fulfill the definitions stated for the Agenda K-step 1.

Web couch potato income from a rental activity try nonpassive earnings when the less than 31% of one’s unadjusted basis of the property put or kept to own fool around with by people in the interest try susceptible to depreciation under section 167. Other Online Leasing Earnings (Loss) , later, to have revealing almost every other web local rental income (loss) other than leasing home. In the event the somebody partcipates in a deal on the partnership, other than from the capability while the somebody, the fresh partner is addressed since the not-being a member of your union regarding transaction. Special legislation connect with conversion or exchanges out of property ranging from partnerships and you may particular individuals, because the informed me in the Club. Generally, the partnership decides how to contour income from its functions.

Acquire Deferral Approach

Concurrently, an ensured fee described within the part 707(c) has never been income of a rental activity. For individuals who aggregate your issues under this type of laws to have point 465 intentions, see the suitable field within the product K underneath the name and you can address cut off to your webpage step one from Function 1065. Install a duplicate out of Form 8832 for the partnership’s Setting 1065 to the taxation 12 months of one’s election. When the two or more number are put in profile extent to go into for the a column, tend to be dollars whenever adding the brand new numbers and you may bullet from precisely the total. A partnership could be necessary to have one of your own following taxation decades. There are many cases where the relationship can obtain automatic concur regarding the Internal revenue service to improve to certain accounting actions.

Sometimes the brand new implicated witch might following become confronted and you will expected to possibly elevator the new curse or pay payment. Whether or not witches are generally perceived as being individual, in many communities he’s paid that have fantastic overall performance maybe not common from the many people. The idea one to witches is travel is actually discovered not just in very early modern European countries (a time covering the fifteenth to 17th centuries) as well as inside the elements of North america, sub-Saharan Africa, Southern area Asia, and you may Melanesia. In some cases they allegedly exercise up on steeds; the aforementioned Nyakyusa for instance held in order to a conviction one to witches travelled on the pythons, if you are of very early modern European countries there are profile away from witches driving up on broomsticks.

However, it absolutely was within the 15th millennium that Christian chapel considered witches “happy disciples” of your own demon, starting a campaign out of browse and you can doing thought witches within the Europe and you can The united states one to survived almost three hundred ages, depending on the Library from Congress. “The thought of wonders profiles or people that did magic is actually in any society, no matter how far-back you are going,” claims Blake. Indeed, based on Mar, witch spells extremely are not far distinct from old-fashioned prayers. Other difference between Wiccans and you will witches is that of many Wiccans abide by the Wiccan Rede, a great credo one to says “Damage nothing and you can manage because you will,” and that generally mode you are able to perform as you please, except if it adversely has an effect on anybody else. Even though many people fool around with “witch” and you can “Wiccan” interchangeably, they’re not fundamentally the same.